Trade Analysis and Tips for Trading the British Pound

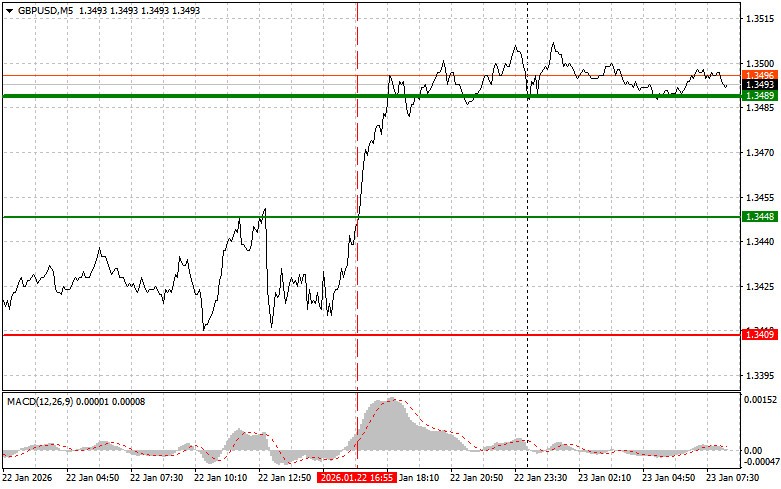

The test of the price at 1.3448 occurred when the MACD indicator had moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the pound and missed all the upward movement.

The influence of American data yesterday was ambiguous. On the one hand, the revised GDP, showing greater economic resilience, should have strengthened the dollar's position. However, inflation data reflected in the personal consumption expenditures index indicate a slowdown in the rate of price growth. This, in turn, leaves the Federal Reserve with room to maneuver in monetary policy, allowing the potential use of rate cuts to stimulate the economy in the event of a worsening situation.

Today, in the first half of trading, market participants will focus on news from the UK: data on changes in retail sales and PMI indices are expected. The dynamics of retail sales always reflect consumer sentiment and the strength of domestic demand. Improved indicators of an increase in retail sales may be seen by the market as confirmation of economic resilience and, consequently, support the pound as the ongoing bull market develops. The PMI indices for the manufacturing sector and the services sector provide valuable information about economic activity in these key sectors. The composite PMI index serves as an important benchmark for assessing the overall state of the British economy. Exceeding expectations on the PMI indices may signal a robust upturn and positively impact the pound.

Regarding the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buy Scenarios

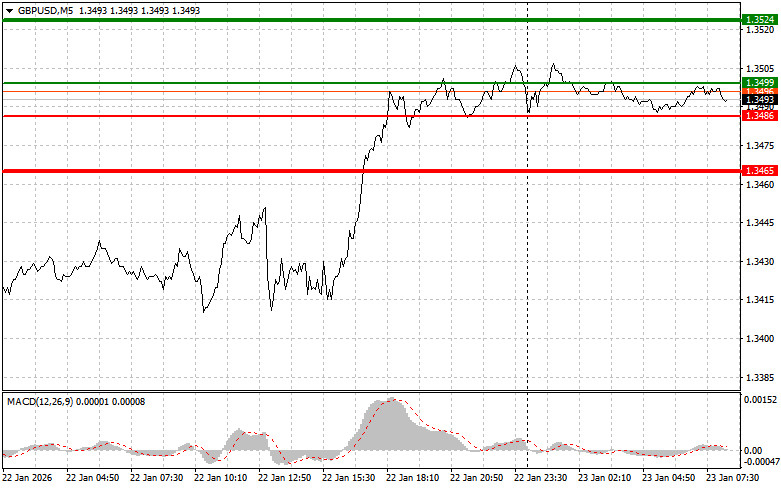

Scenario #1: Today, I plan to buy the pound at the entry point around 1.3499 (green line on the chart), with a target for growth to 1.3524 (the thicker green line on the chart). At the 1.3524 level, I plan to exit the market and sell immediately on the rebound (aiming for a 30-35-pip move in the opposite direction from the level). Pound growth can only be expected after strong data. Important! Before buying, ensure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy the pound today if the price tests 1.3486 twice in a row while the MACD indicator is oversold. This will limit the pair's downside potential and lead to a market reversal. An increase can be expected towards the opposing levels of 1.3499 and 1.3524.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3486 level is updated (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the level of 1.3465, where I intend to exit the market and immediately buy in the opposite direction (aiming for a movement of 20-25 pips in the opposite direction from the level). Pound sellers may emerge following weak data. Important! Before selling, ensure the MACD indicator is below the zero line and just starting its decline.

Scenario #2: I also plan to sell the pound today if the price tests 1.3499 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline can be expected to the opposing levels of 1.3486 and 1.3465.

What is on the chart

- Thin green line — entry price at which you can buy the instrument

- Thick green line — suggested Take Profit price or level at which to manually lock in profit, since further rise above this level is unlikely.

- Thin red line — entry price at which you can sell the instrument

- Thick red line — suggested Take Profit price or level at which to manually lock in profit, since further decline below this level is unlikely.

- MACD indicator — when entering the market, it is important to follow the overbought and oversold zones

- Important notes: Beginner forex traders must be very cautious when deciding to enter the market. It is best to be out of the market before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit quickly, especially if you do not use money management and trade large volumes.

- Remember that successful trading requires a clear trading plan like the one presented above. Spontaneous trading decisions based on current market noise are a losing strategy for the intraday trader.