The GBP/USD currency pair traded very calmly during Wednesday, while a report was released in the UK that could turn everything upside down. Recall that a day earlier, an unemployment report indicated an increase of 0.1%. The market's reaction was tumultuous, driving the British currency by more than 100 pips. However, the next day, when the consumer price index was reported to have decreased to 3%, practically guaranteeing a new easing of monetary policy by the Bank of England, the market's reaction was virtually non-existent...

On the one hand, the traders' reaction was understandable, since the report's actual figure matched expectations. Yet, the fact that inflation slowed to 3% is not an ordinary event. It will significantly influence the central bank's mood, making it very important. We believe that the fall of the British currency on Tuesday partially reflected the slowdown in inflation on Wednesday. If that is the case, then both factors have been fully accounted for, as has the anticipated easing of the Bank of England's monetary policy. Of course, this is only a hypothesis, but even after the week's drop, the upward trend in the British pound on the daily timeframe has not disappeared, and the fundamental backdrop for the dollar has not suddenly become more optimistic.

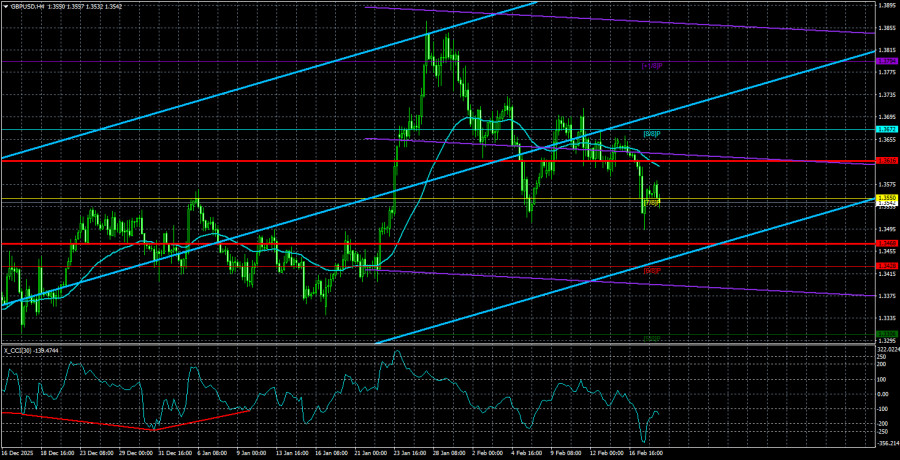

We also want to note one very important technical point. Tuesday ended with a breach of the previous local low, which is clearly visible on the 4-hour timeframe. In the ICT trading system, such a breach is referred to as a "liquidity grab" and usually serves as a warning to traders of an impending reversal. Besides the "liquidity grab," the CCI indicator entered the oversold area on Tuesday, which also signals a potential increase.

What do we have in total? The "bearish" factors have been addressed; the fundamentals and macroeconomics in the US are, at the very least, questionable and contradictory, and there are at least two technical warnings of a rise in the pair, while the overall trend remains upward. In our view, the probability of the pair rising in the coming weeks is again very high. Moreover, the European currency is likely to rise.

This week, traders must also survive Friday, when business activity indexes and retail sales will be published in the UK, and in the US, the first estimate of GDP growth for the fourth quarter will be released. It is expected that the US economic growth will slow to 3%, while British business activity will remain strong (above the "waterline" of 50.0) in both sectors. Thus, the macroeconomic backdrop for the remainder of the week may support the British pound, while technical indicators have not supported the dollar in recent weeks and months. We still believe that global fundamental factors will pull the dollar down like a twelve-pound anchor tied to the feet of a prisoner. The dollar can only hope for corrections and retracements.

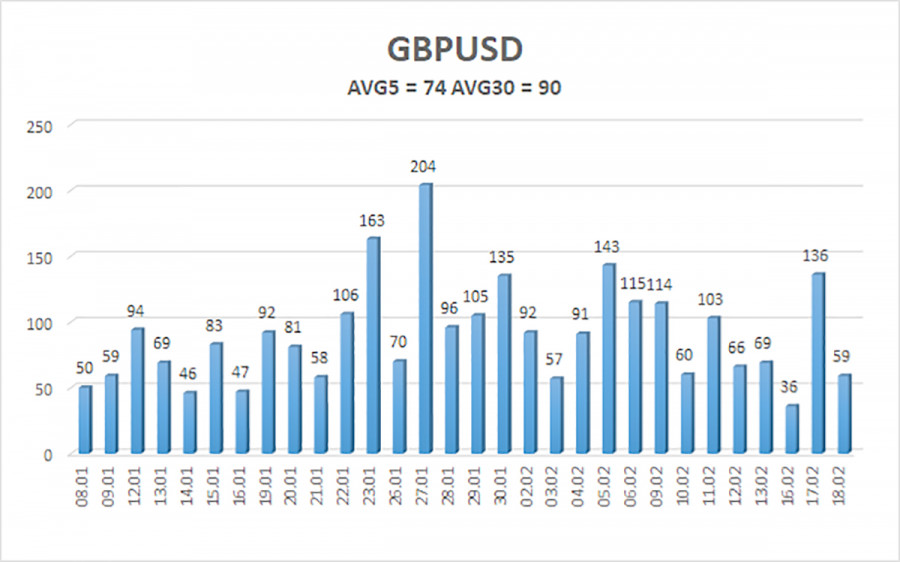

The average volatility of the GBP/USD pair over the last 5 trading days is 74 pips. For the pound/dollar pair, this value is considered "average." On Thursday, February 19, we expect movements within the range of 1.3468 to 1.3616. The upper channel of the linear regression points upward, indicating a recovery of the trend. The CCI indicator has entered oversold territory, signaling a possible end to the correction.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair is on track to continue its 2025 upward trend, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "reserve currency" no longer holds much significance for traders. Thus, long positions with a target of 1.3916 and above remain relevant for the near term when the price is above the moving average. When the price is below the moving average line, small short positions can be considered with targets of 1.3468 and 1.3428 on a technical (corrective) basis. From time to time, the American currency shows corrections (in a global sense), but for trend growth, it needs global positive factors.

Explanations for Illustrations:

Regression channels help determine the current trend. If both are oriented in the same direction, it indicates a strong trend;

The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

Murray levels are target levels for movements and corrections;

Volatility levels (red lines) are the probable price channel in which the pair will operate in the next 24 hours, based on current volatility indicators;

The CCI indicator—its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.