The EUR/USD currency pair traded very calmly on Wednesday until the release of the Non-Farm Payrolls and unemployment reports. This is not surprising, as the market had been waiting for these reports since last week. Instead of Non-Farm Payrolls and unemployment data, traders had to settle for the ADP, JOLTs, and standard unemployment claims reports. All three of these reports were disappointing, adding fuel to the fire that the dollar has been burning under for over a year.

Despite strong GDP growth, more and more experts are pointing out the artificial nature of this growth. Recall that a few days ago, Donald Trump stated he expects Kevin Warsh to accelerate the economy to 15%. Many took this statement as a joke, but it is clear where Trump is aiming. He wants to boost the US economy even further. By what means and methods? Experts note that the real purchasing power of the American population is declining. We have previously mentioned that official inflation remains relatively low, but prices are still rising, as many American consumers have observed. This creates a paradox: the economy is growing, but purchasing power is falling, household burdens are increasing, and the number of dissatisfied individuals with Trump's policies is rapidly rising.

Separately, we should highlight the beleaguered US labor market. The downturn is evident to the naked eye. The labor market is the foundation of any economy. If the population cannot find work, they cannot pay loans, make purchases, receive medical treatment, or pay for services. Once again, everything looks manageable on paper. Unemployment is just 4.4%, and the labor market is, admittedly, creating jobs. But why are more and more Americans reporting an inability to find employment and taking to the streets to protest?

We propose analyzing the situation surrounding the dollar and the US as a whole, rather than through isolated reports. Individual macroeconomic reports may support the American currency simply because their actual figures exceeded expectations. This economic paradox has been noted before. If, for instance, the forecast for the Non-Farm Payroll report is 20,000, but the actual figure is 30,000, it means conditions are better than the market had anticipated, and the dollar rises. However, practically all traders and economists understand that even 50,000 new jobs per month is exceedingly low, and insufficient to prevent unemployment from increasing.

In our view, the technical analysis currently best illustrates the situation. Look at the daily timeframe: since Donald Trump became president for the second time, the dollar has either fallen or, at best, remained stagnant. Thus, there has been no significant growth against the euro (its most significant competitor) over the last 13 months. We still do not see anything that could allow the American currency to expect growth, especially since Trump openly welcomes its decline.

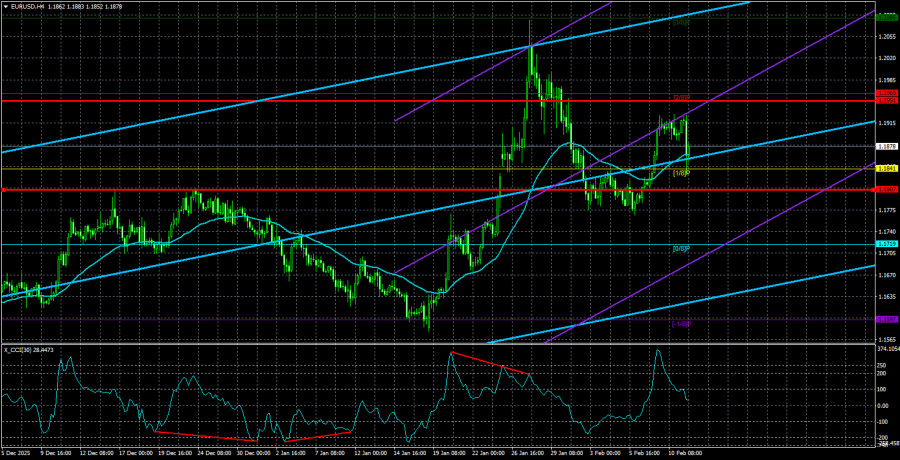

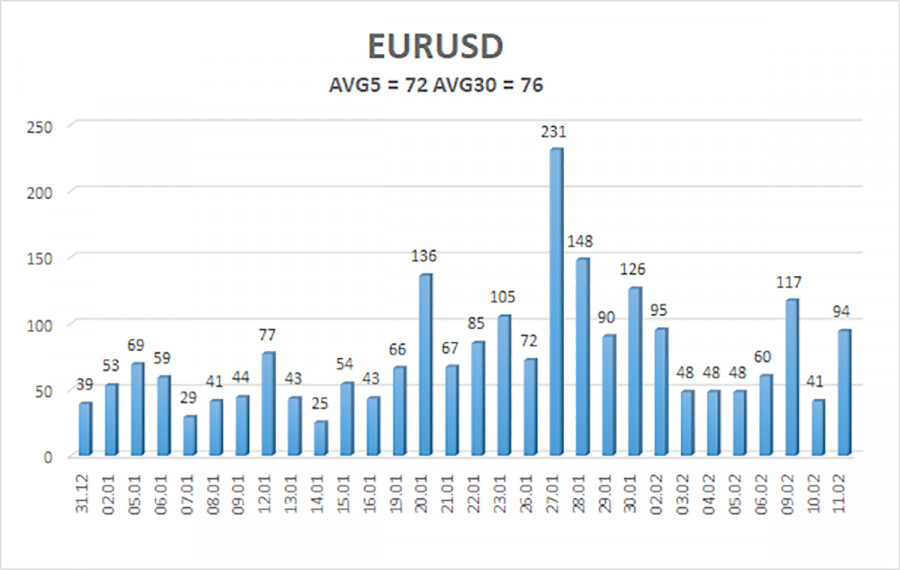

The average volatility of the EUR/USD pair over the last 5 trading days as of February 12 is 72 pips, which is considered "average." We expect the pair to trade between 1.1807 and 1.1951 on Thursday—the upper channel of the linear regression points upward, indicating further growth for the euro. The CCI indicator has entered the overbought zone, warning of a possible pullback.

Nearest Support Levels:

- S1 – 1.1841

- S2 – 1.1719

- S3 – 1.1597

Nearest Resistance Levels:

- R1 – 1.1963

- R2 – 1.2085

- R3 – 1.2207

Trading Recommendations:

The EUR/USD pair is continuing a strong correction within the upward trend. The global fundamental backdrop remains critically negative for the dollar. The pair spent seven months in a sideways channel, and it is likely that now is the time to resume the global trend from 2025. The dollar lacks a fundamental basis for long-term growth. Therefore, all the dollar can hope for is a flat or a correction. If the price is below the moving average, small shorts can be considered with a target of 1.1719 based purely on technical grounds. Above the moving average line, long positions remain relevant with targets at 1.1963 and 1.2085.

Explanations of the Illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, it means the trend is strong at the moment.

- The moving average line (settings 20.0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the likely price channel in which the pair will move over the next day, based on current volatility readings.

- The CCI indicator's entry into the oversold area (below -250) or overbought area (above +250) indicates a potential trend reversal in the opposite direction.