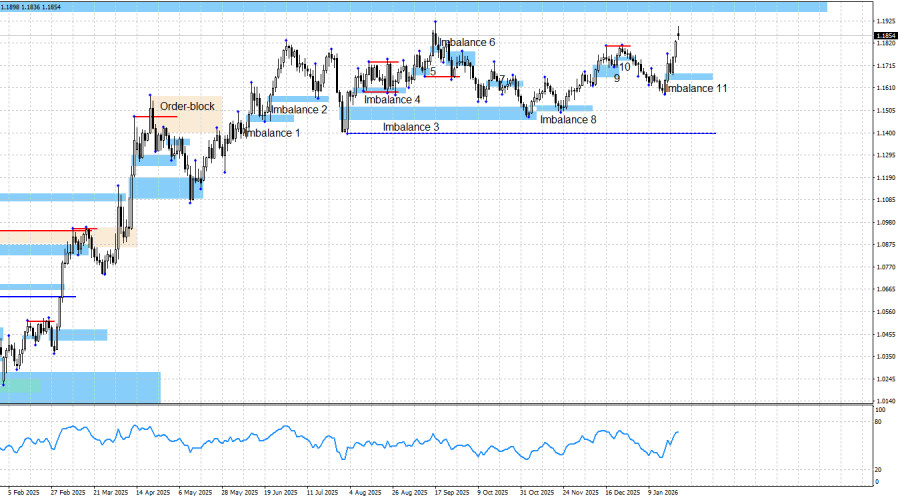

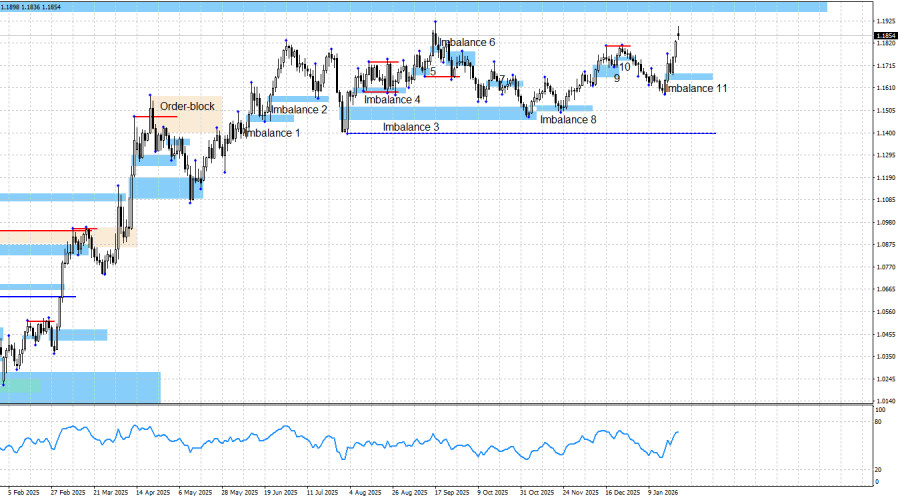

The EUR/USD pair reversed in favor of the European currency last week and began a new upward move. As expected, any bearish attacks have extremely limited potential, and the bullish trend remains intact. In a bullish trend, traders should focus primarily on bullish patterns and buy signals. Last week, another bullish imbalance was formed and was followed almost immediately by a buy signal. As a result, traders once again had an excellent opportunity to open positions that are already showing profits of around 120–130 points.

Undoubtedly, Donald Trump deserves credit for the latest decline in the dollar. Throughout last week, traders paid no attention whatsoever to economic reports. The peak of this disregard was the release of U.S. Q3 GDP data, which came in stronger than expected. Donald Trump first imposed trade tariffs on EU countries and then canceled them—but traders saw only negativity in both events. In my view, they interpreted the situation absolutely correctly, because such chaos signals only one thing: decisions made by the U.S. president (of the world's largest economy, no less) carry little weight. Today Trump may impose tariffs; tomorrow he may cancel them. Today he may declare readiness to seize Greenland by force; tomorrow he may change his mind. Today he has claims against Europe, tomorrow against China, the day after against Canada. Markets cannot understand what to expect from Trump and therefore price in the worst-case scenario. As a result, they prefer to get rid of the U.S. currency whenever possible. At the moment, dollar selling is not yet widespread, but we have a new signal, and I expect further growth in the pair.

The chart picture continues to signal bullish dominance in the long term. The bullish trend remains intact despite the sideways movement seen in recent months. A new bullish signal has formed at imbalance 11, which allows expectations for growth at least toward 1.1976 (the lower boundary of the weekly imbalance). As early as today, another bullish imbalance may form, from which new buy trades could once again be initiated.

The information backdrop on Monday gave traders fresh food for thought. Donald Trump threatened to impose 100% tariffs on Canada if it continues free trade with China. As we can see, the headline "Trump attacks" only needs a new country name each week—the meaning remains the same. On Monday, the dollar avoided another drop, but the day is not over yet.

Bulls have had more than enough reasons for a renewed offensive for the past 4–5 months, and each day only adds to them. These include the inevitably dovish outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the U.S.–China confrontation (where only a temporary truce has occurred), protests by the American public against Trump under the banner "No kings," weakness in the labor market, bleak prospects for the U.S. economy (recession), and the government shutdown (which lasted a month and a half but was clearly not fully priced in by traders). Now add U.S. military aggression toward certain countries, criminal proceedings against Powell, and the "Greenland mess." In my opinion, further growth of the pair under these conditions is entirely logical.

I still do not believe in a bearish trend. The information backdrop remains extremely difficult to interpret in favor of the dollar, which is why I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered over. Bears would need to push prices down by about 460 points to reach it, and I consider this task impossible under the current information backdrop and circumstances. The nearest upside target for the euro remains the bearish imbalance 1.1976–1.2092 on the weekly chart, formed back in June 2021.

News Calendar for the U.S. and the Eurozone:

- United States – ADP Employment Change (13:15 UTC)

- Eurozone – Speech by ECB President Christine Lagarde (17:00 UTC)

On January 27, the economic calendar contains two events, neither of which is of significant interest. The impact of the news flow on market sentiment on Tuesday may be very limited.

EUR/USD Forecast and Trading Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the information backdrop favoring bulls, bears have carried out regular attacks in recent months. However, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we saw some degree of growth, and the bullish trend remained intact. Last week, a new bullish signal formed from imbalance 11, once again allowing traders to open long positions with a target of 1.1976. Another bullish imbalance may form this week as well. I remain firmly bullish.