If your temperament prevents you from opening medium and long-term traders, this article is for you.

We are going to talk about short-term intraday trading strategies. You will learn about the main features, pros and cons of intraday trading, as well as find out which assets are best to choose for short-term trading.

You can learn more about intraday trading strategies and how to apply them in the article "Forex Strategies for Beginners".

Intraday Trading

Intraday trading is one of the main types of short-term strategies. Its main feature is that transactions are not held overnight.

At the same time, when using this strategy, there is no need to trade every day. You can do this only a few days a week.

This type of trading is quite convenient as you do not need to wait long for the result. Within a few hours from the opening of the transaction, you will either make a profit or incur losses.

This is the main reason why many traders, especially beginners, choose this strategy. However, it is necessary to understand that the success of such a trade depends on many factors.

Firstly, a trader needs to constantly monitor the market situation and be ready to react promptly to price changes.

Secondly, this strategy is based on technical analysis which requires a deep understanding and skillful use of technical indicators.

Thirdly, you should choose the right assets for trading. For intraday trading, only highly liquid assets are suitable. Their price can change considerably over short periods of time.

What is more, you need to be able to control your emotions and not make rash decisions, especially in a situation when you want to recoup your losses.

Last but not least, by all means, you should avoid greed. You need to always stop trading when you have achieved the necessary result. If the price has already reached the level you expected, lock in profits without expecting further growth.

The asset may either continue to grow or decrease sharply. In this case, instead of the already earned profit, you could face losses.

Pros and cons

Like any other trading strategy, intraday trading has both its advantages and disadvantages. Let's discuss them in more detail.

Here are the main advantages of this strategy:

- Opportunity to earn quick short-term profits. With the proper use of this strategy, you can generate profits after one trading day. By opening several transactions a day, you may significantly increase your capital.

- A simpler analysis. It is easier to predict the price movement of an asset in the short term, that is, within a few hours than during a week, month, or year.

- Better control of your trades. Since you are constantly monitoring the market situation, you can close an unprofitable position at any time or make any other adjustments.

- Opportunity to open large transactions. As you can constantly track market changes and make a forecast for one trading day, you can open transactions of larger volumes than with medium-term trading.

- No impact of price gaps. As intraday traders do not open positions at night, they can sleep peacefully without worrying that their positions may become unprofitable overnight. The news released on weekends or over-the-counter hours has less impact on their trading. However, they should monitor all the news that appears during the day.

- New opportunities every day. With such a strategy, every new day brings new opportunities. All yesterday's positions are closed, you can start a new trading day with a clean page.

- Experience. When you are constantly trading, you can learn from your mistakes much faster and gain experience.

- Flexibility. With such a strategy, you can easily manage your capital by choosing assets, selling some, and buying others. Hence, you can always use your capital to earn extra money every day.

Now, let’s talk about the disadvantages:

- Commissions. Compared to medium-term and long-term strategies, traders open many positions. The more transactions they make, the bigger the total amount of commissions they are charged.

- Concentration and readiness to work in a rapidly changing market. Speculators constantly need to keep their finger on the pulse so as not to miss the moments when it is necessary to change or close a position. However, intraday trading does not set any specific rules for how many transactions you need to make in one day.

- High-stress levels. Due to the fact that you should look non-stop at the computer screen to follow price changes, there is almost no time for rest and other things. Fatigue and stress increase which eventually could lead to a decline in trading efficiency.

- Preparation for each trading day. In order not to make hasty decisions, you should first think about how many and what kind of trades you will open.

- Technical requirements. If you want to succeed by using short-term algorithms, you should have a computer with high speed and accuracy as well as a stable Internet connection.

- Limited time to make a decision. If you have a well-thought strategy, this will not be a problem. However, if there is no developed strategy, it may become a problem as it could be difficult to make the right decision quickly.

Which traders should choose intraday trading

Having studied the main features, pros and cons of intraday trading, you can see that this strategy is not suitable for everyone.

This type of trading will be perfect for traders who do not want to wait for months and years to see the result of their work.

At the same time, such a strategy cannot be recommended to beginners as it requires a well-developed strategy for any of the situations that may arise in the market.

There could be little time to make a decision. So, there is a high probability of making a mistake if there is no knowledge of how to act in a particular situation.

In addition, such trading requires a sufficient amount of time and concentration.

It is important that investors do not miss the moments when the market situation is changing and react promptly to these changes.

Traders need to assess the technical characteristics of their computers and the speed of the Internet before starting short-term trading. Otherwise, technical problems will lead to losses.

You should know what temperament you have. Short-term trading is a good choice for sanguine and phlegmatic people.

Sanguine people tend to have a positive outlook on life. They handle failures better. Traders with such a temperament also strive to get maximum income in a short time.

Phlegmatic people are more reasonable and less affected by stress and negative emotions. They can make decisions calmly and carefully.

For melancholics and choleric people, this type of trading is not suitable. Choleric people are very hot-tempered and impatient. They can make rash decisions and may be overwhelmed by emotions.

Melancholics, on the contrary, are too calm. They are unwilling to take a risk. They are too cautious. It is hard for them to recover from failures, even small ones.

Best stocks for intraday trading

When talking about stocks, many people will probably think of investments. In reality, stock trading can be carried out in two ways: investing and trading.

When investing, speculators buy shares for a long term, e.g. from 1 year, betting on an increase in the price of these assets over time.

This method of investing has low risks, provided that speculators have chosen the right shares for investment.

At the same time, portfolio diversification is the key to success in long-term strategies.

You should never put all your eggs in one basket, that is, invest all your funds in one asset, no matter how attractive it may initially seem.

It is quite difficult to predict whether it will retain bullish momentum in a year or two.

When you have invested your funds in several different assets, you may avoid losses if some stocks decline. You could make a profit from others.

The main advantage of such a strategy is that you do not need to constantly monitor changes in the market. It is enough to see that there is a steady uptrend.

Short-term price swings and market volatility do not affect long-term investment.

Stock trading may be quite intense. The number of transactions can vary from several per day to several per month.

In this type of trading, the risks are higher as short-term factors and market volatility have an impact on the asset price.

However, traders should be ready for these risks and use them as an opportunity to get more profit in a shorter period of time.

To achieve success in stock trading, speculators need to be able to analyze the market well and correctly identify the entry points.

They are responsible for the decisions they make. They can only count on themselves, their knowledge, and their experience.

Some traders prefer to trade the same stocks. They believe that they have enough information about a particular company and can determine price movements.

However, do not limit yourself only to particular companies and their shares. After all, the market is big and offers new opportunities every day.

Guideline for intraday trading

If you choose intraday trading, we recommend you get acquainted with the main rules.

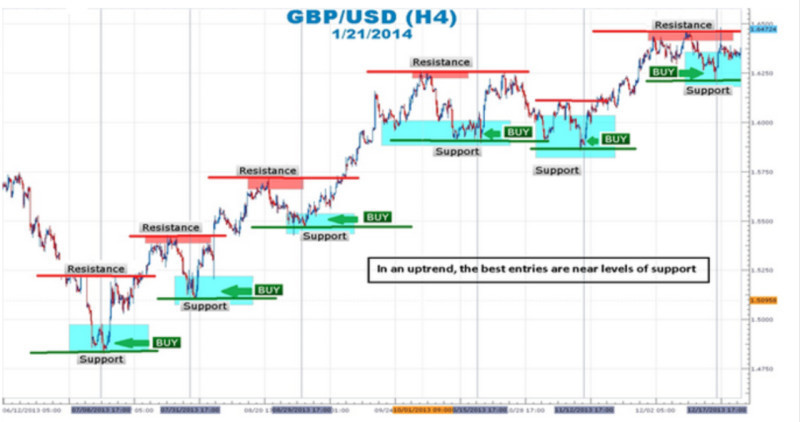

1. Trade only along with the trend. Although some investors try to go against the trend, this is not exactly the best strategy, especially for intraday trading. It is necessary to clearly determine the prevailing trend and trade according to this trend.

2. Choose strong stocks when the market is bullish and weak ones when the market is bearish. There is a correlation between the movement of main stock indices such as the S&P 500 or the NASDAQ and the trajectory of stocks included in these indices. When the indices grow, some of the stocks may climb markedly.

3. Be patient. The market has a wave-like movement, you need to wait for the price reversal to open more profitable positions. After that, an upward movement begins again, enabling you to generate income.

4. Lock in profits. If your trade is unprofitable, close it as quickly as possible. For profitable trades, place the Take Profit order around the previous high.

5. Do not trade when the market is flat. In intraday trading, only more or less strong fluctuations in the asset price may bring profit. If the price moves in a narrow range, there will hardly be an opportunity to earn.

Intraday trading does not mean that you have to do trading every day. If you see that there are no favorable market conditions at a certain period, it is better not to trade at all.

You should not try to trade a large number of assets at once. You simply cannot monitor the situation on ten or more charts at the same time. It will eventually lead to losses, not profit.

What strategies one should apply

When trading stocks, there is one important rule that should always be taken into account. Buy when the price starts to rise and sell when the price declines.

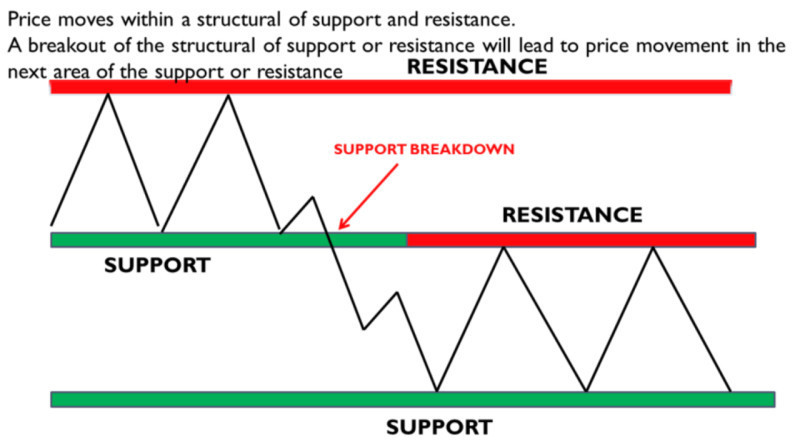

Usually, a channel appears on the chart which is limited by the support and resistance levels. Most trades are opened and closed at these levels.

Bills and bears tussle for these levels. So, they constantly change.

So, let's look at some intraday trading strategies.

1) Rebound strategy. When applying such a strategy, traders expect that the price after having reached a certain level will make a reversal from it and start moving in the opposite direction.

2) Breakout strategy. There may be a situation when the price breaks through the support and resistance levels. When it goes through the upper border, it signals the bullish market. Therefore, you can go long. If the price falls below the lower border, you need to open a short position as the downtrend prevails,

3) Market gap strategy. There are days when the market is growing and the price is unable to reach the support level. If it does, it quickly retreats. On such days, you have a perfect opportunity to make money on price gaps by opening long positions.

4) Reversal strategy. You should identify the levels where the price is likely to rebound from the upper and lower borders. As a rule, before changing the direction, the price rolls back a little. This is the perfect moment to enter the market.

5) Scalping. This is one of the types of intraday trading strategies, which implies opening a large number of short-term trades. Investors strive to make profits in small amounts.

Best indicators for intraday trading strategies

For the effective use of almost all of the above strategies, it is necessary to have a broad knowledge of technical indicators. The most popular timeframes are M5-M15.

Let's discuss which of the indicators you should use in intraday trading.

- Moving averages are an indicator that is used in almost all strategies, not only intraday ones. As a rule, two moving averages, namely fast and slow, are plotted on the chart. The entry point is the moment when these lines intersect.

- The MACD indicator is most effective when there are strong price fluctuations in the market. This indicator includes three elements: the MACD line, a signal line, and a histogram, charted around a horizontal axis known as the baseline. Traders usually see entry points when there is an intersection of the MACD and signal lines.

- Oscillator is an indicator that helps identify the direction, strength, or weakness of a trend before making a trade. By using it, it is possible to predict the level at which the asset price will change its direction.

- The RSI indicator enables speculators to identify the strength of the trend and its length. It also points to overbought or oversold conditions.

- On-balance volume (OBV) is a momentum indicator that uses volume flow to predict changes in stock price over a selected period of time. When this indicator drops, it signals a downtrend and when it rises, an uptrend may begin.

Most indicators do not work very effectively separately. This is why it is better to use several of these indicators at the same time. In this case, they work perfectly as they complement each other and negate the drawbacks of each other.

Thus, by using several indicators at once, you can get a better understanding of the market situation and determine buy or sell signals more accurately.

Conclusion

In this article, we have told you about the most important features of intraday trading.

Like any other strategy, it has its pros and cons. However, if you use it properly, it could bring you solid profit.

It is not suitable for all traders. It will be a perfect choice for traders who are interested in short-term trades and quick profit. Day traders want to see the results in a short time and be able to flexibly manage their capital.

Intraday trading strategies does not imply that you need to trade every day. On the contrary, there are days when it is better to take a break.

However, when you trade, you should be really focused and keep your finger on the pulse so as not to miss important signals.

It is also crucial that you choose the right assets, e.g. high-liquid and volatile ones.

There are several strategies and indicators that help you carry out intraday trading more effectively. It is better to apply several indicators at once.

You may also like:

Forex swing trading strategies

Back to articles

Back to articles