To open long positions on EUR/USD, you need:

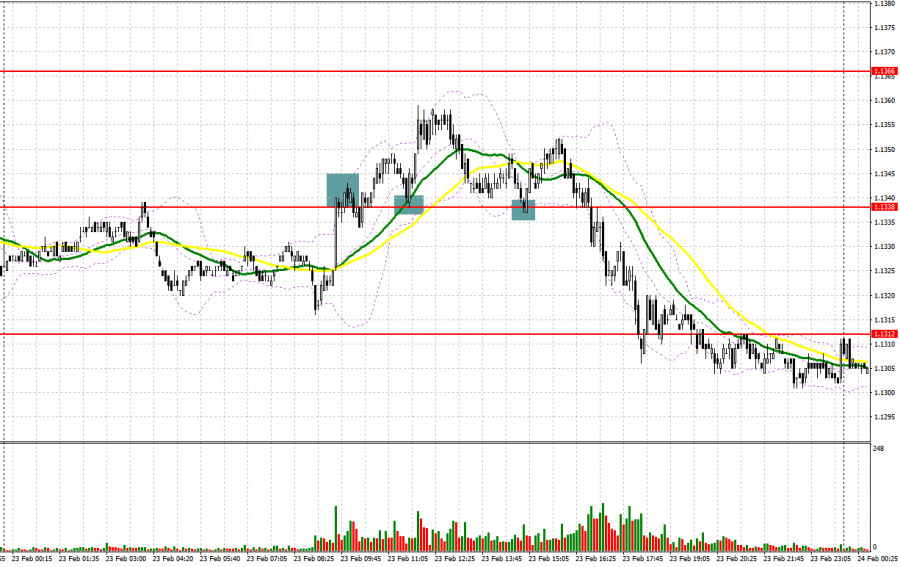

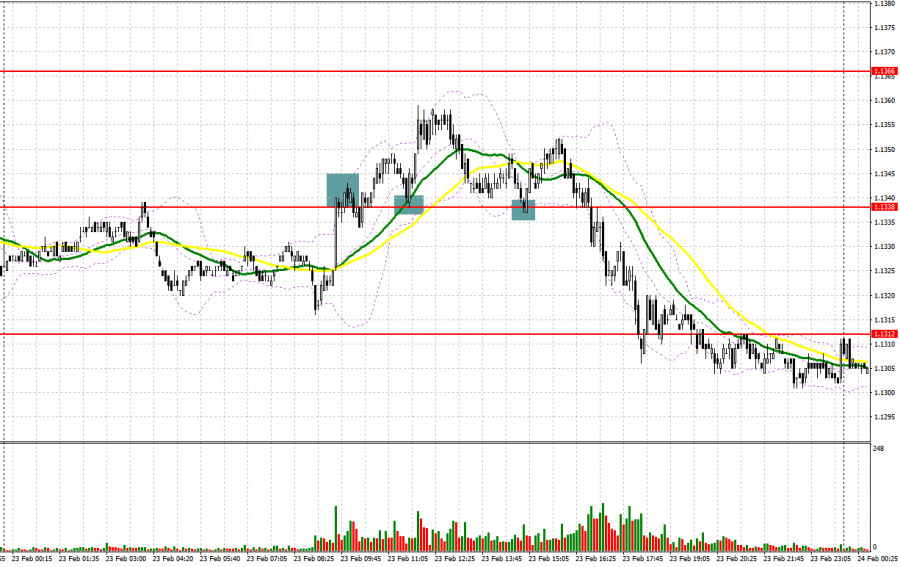

Yesterday, several signals were formed to enter the market. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1338 level and advised making decisions on entering the market from it. The disappointing report on Germany resulted in a false breakout in the resistance area of 1.1338, but there was no downward movement from this level. A breakthrough and consolidation above this range, and then a reverse test from top to bottom - all this provided an excellent entry point into long positions. It all ended with a 20-point increase and the return of the euro to the 1.1338 area. Another false breakout was formed at the beginning of the US session, but there was even less upward movement - about 10 points.

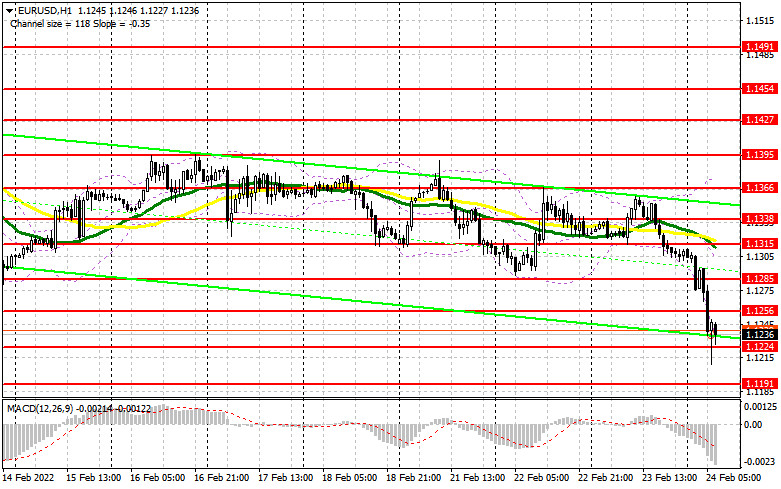

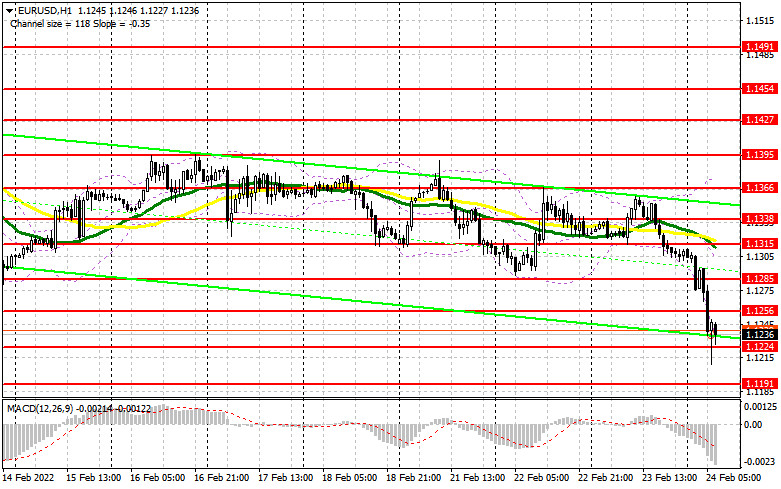

The euro collapsed against the US dollar during the Asian session due to Russia's military actions on the territory of Ukraine. The escalation of the conflict has moved into the armed stage, which greatly affects risky assets. So far, there is no need to talk about any fundamental background, since everyone will be focused on the further actions of the Russian authorities and retaliatory measures by the EU and the United States. The direction of the EUR/USD pair will depend on this. You should not rush when opening long positions. It is important to protect the support of 1.1224 in the first half of the day, which has an intermediate value, so if there is no activity there, it is better not to rush with long positions. Forming a false breakout at this level creates the first entry point into long positions, counting on a slight recovery of the euro to the area of 1.1256. However, in order to count on a larger increase in EUR/USD, bulls should be more active and be able to surpass this resistance.

There are no statistics on the eurozone today, so the focus will be on the speech of European Central Bank Executive Board member Isabelle Schnabel. Her statements are unlikely to affect the market in any way. Therefore, only a breakthrough and a top-down test of 1.1256 will lead to another buy signal and open up the possibility of restoring the pair to the area of 1.1285. A breakthrough of this range will also stop the bearish trend and open a direct road to a high of 1.1315, where I recommend taking profits. With the further aggravation of the geopolitical conflict, the demand for the US dollar will remain. The optimal scenario for buying would be a false breakout at 1.1191, but you can buy the euro immediately for a rebound from the lows: 1.1154 and 1.1113, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Bears acted with lightning speed in today's Asian session, and most likely the pressure on the euro will only increase. To strengthen bearish sentiment, it is necessary to protect the resistance of 1.1256. Forming a false breakout at this level, together with the aggravation of the military conflict between Russia and Ukraine, as well as retaliatory sanctions from the United States and the EU — all this will be a signal to open short positions in order to further pull the euro along the trend to the intermediate level of 1.1224. A breakthrough of this area and a reverse test from the bottom up will provide another signal to open short positions already with the prospect of falling to a low of 1.1191, and there is a direct road to 1.1154 and 1.1113, where I recommend taking profits. In case the euro grows and the bears are not active at 1.1256, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1285. You can sell EUR/USD immediately on a rebound from 1.1315, or even higher - around 1.1338, counting on a downward correction of 15-20 points. As I noted above, fundamental statistics will not overshadow what is happening in the global political arena right now, so I recommend starting only from technical analysis when making decisions.

I recommend for review:

The Commitment of Traders (COT) report for February 15 showed that both long and short positions have decreased, which led to an increase in the positive delta, as there were much fewer short positions. The uncertain policy of the European Central Bank, together with its president Christine Lagarde, who recently said that it was necessary to act more aggressively in the event of an acceleration of inflationary pressure, and last week completely changed her position, leads traders to a dead end. But even despite the growth of the positive delta, the euro sank very much at the end of the reporting period. This is happening against the background of the risk of a military conflict between Russia and Ukraine. More recently, the Russian authorities recognized the independence of the LDPR, which only exacerbated geopolitical tensions around the world. Another weighty argument for the observed downward movement of the EUR/USD pair is the actions of the Federal Reserve in relation to interest rates. According to the Fed minutes from the February meeting, it is expected that the central bank may resort to more aggressive actions and raise rates immediately by 0.5% in March this year, and not by 0.25%, as originally planned. This is a kind of bullish signal for the US dollar. The COT report indicates that long non-commercial positions decreased very slightly from the level of 218,973 to the level of 217,899, while short non-commercial positions decreased from the level of 180,131 to the level of 170,318. This suggests that although there are fewer people willing to sell euros, there are no more bulls from this. It seems that traders prefer to sit on the sidelines of those events that are now rapidly gaining momentum. At the end of the week, the total non-commercial net position increased slightly and amounted to 47,581 against 38,842. The weekly closing price collapsed and amounted to 1.1305 against 1.1441 a week earlier.

Indicator signals:

Trading is below the 30 and 50 daily moving averages, indicating a bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the average border of the indicator in the area of 1.1315 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.