The EUR/USD currency pair traded much more calmly on Thursday than on Wednesday, which can be attributed to the limited number of macroeconomic and fundamental events. Recall that important reports on industrial production, service sector activity, and the labor market were released in the U.S. on Wednesday. However, the first two were of secondary interest to the market, whereas the last report was of primary interest.

It should be noted that the ADP report is not the most influential indicator of the state of the U.S. labor market. It only covers data from the private sector, ignoring, for example, the public and non-profit sectors. Therefore, while one can draw certain conclusions from this report, the market tends to rely on the Nonfarm Payrolls report for its assessments. However, there are no Nonfarm Payrolls reports available—literally. The shutdown in America has ended, but important macroeconomic data have not returned. This is primarily because it will take considerable time to collect, compile, and present the final reports. The next Nonfarm Payrolls report will be released on December 16, and the next inflation report will be published on December 18. The last Federal Reserve meeting of the year will take place on December 10.

It is worth noting that Jerome Powell and the Federal Reserve have repeatedly stated that monetary policy decisions will be based solely on economic data. But how can decisions be made when no data is available?

Thus, the only report available to Fed officials at their December meeting will be the ADP report. The ADP report showed the lowest numbers in two years (since March 2023) for November. This indicates that the labor market continues to decline (even if it's not the case, and the ADP report is inaccurate), and there are no other labor market data available. Meanwhile, inflation continues to rise (as evidenced by the reports of recent months). A declining labor market calls for monetary policy easing, while rising inflation necessitates tightening. This brings us back to the dilemma that has existed in FOMC corridors since last summer: what to do and whom to save?

In general, markets hardly doubt that the Fed will lower the key rate by another 0.25% next week. We also share this belief, as the ADP report only leads to such a conclusion. Consequently, the U.S. dollar has received yet another factor for decline, adding to the long list of factors we continually discuss. The American currency is declining, which is pleasing and aligns with our expectations. It is falling slowly, not in a hurry, as if the market doesn't fully believe in the easing of monetary policy next week. However, a flat on the daily timeframe persists, so we cannot expect high volatility yet. The price is steadily moving from the lower boundary of the sideways channel at 1.1400 to the upper boundary at 1.1830.

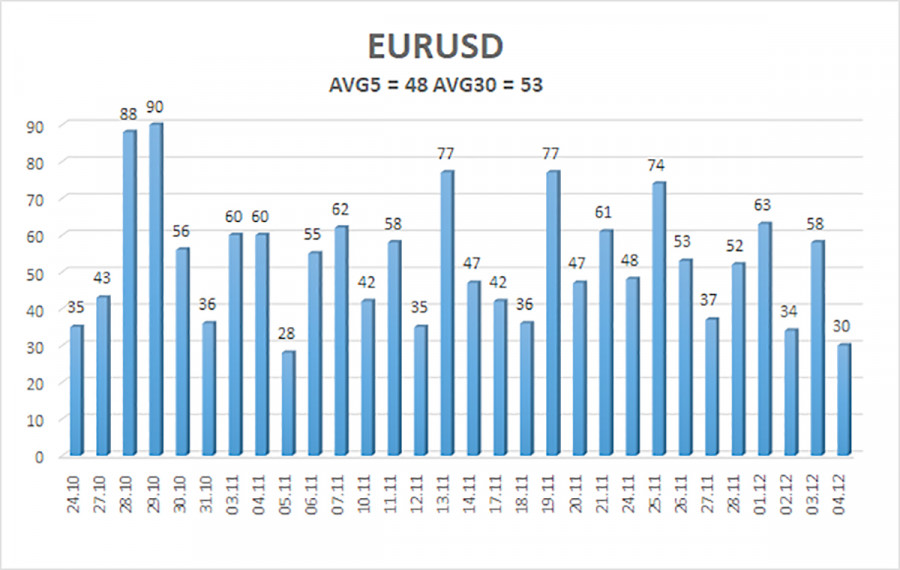

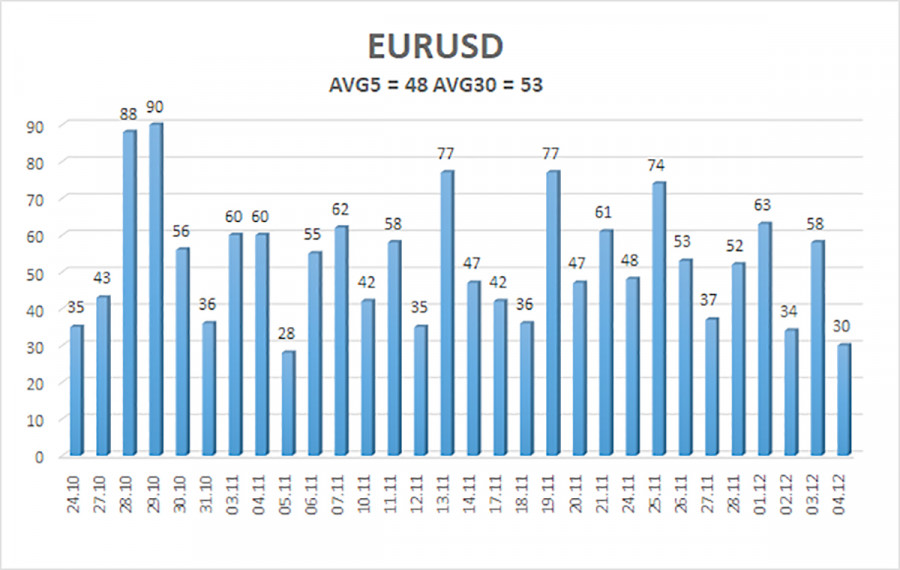

The average volatility of the EUR/USD currency pair over the last five trading days, as of December 5, is 48 pips and is characterized as "medium-low." We expect the pair to trade between 1.1611 and 1.1707 on Friday. The upper linear regression channel is directed downward, indicating a bearish trend, but in fact, a flat continues on the daily timeframe. The CCI indicator has entered the oversold area twice in October, which could provoke a new wave of the upward trend in 2025.

Closest Support Levels:

- S1 – 1.1658

- S2 – 1.1627

- S3 – 1.1597

Closest Resistance Levels:

- R1 – 1.1688

- R2 – 1.1719

- R3 – 1.1749

Trading Recommendations:

The EUR/USD pair remains below its moving average, but an upward trend persists across all higher timeframes, while a flat has persisted for several months on the daily timeframe. The global fundamental background still holds significant importance for the market. Recently, the dollar has shown growth, but only within the bounds of a sideways channel. There is no fundamental basis for long-term growth. When the price is below the moving average, small short positions can be considered with targets at 1.1566 and 1.1536 on purely technical grounds. Above the moving average line, long positions remain relevant with a target at 1.1800 (the upper line of the flat on the daily timeframe).

Illustration Explanations:

- Linear Regression Channels: Help determine the current trend. If both are directed in the same way, it indicates a strong trend.

- Moving Average (settings 20,0, smoothed): Defines the short-term trend and the direction for current trades.

- Murray Levels: Target levels for movements and corrections.

- Volatility Levels (red lines): The probable price channel in which the pair will spend the next 24 hours based on current volatility metrics.

- CCI Indicator: Its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.